how does hawaii tax capital gains

Credit of 2 of capital gains. Hawaii also has a 440 to 640 percent corporate income tax rate.

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition

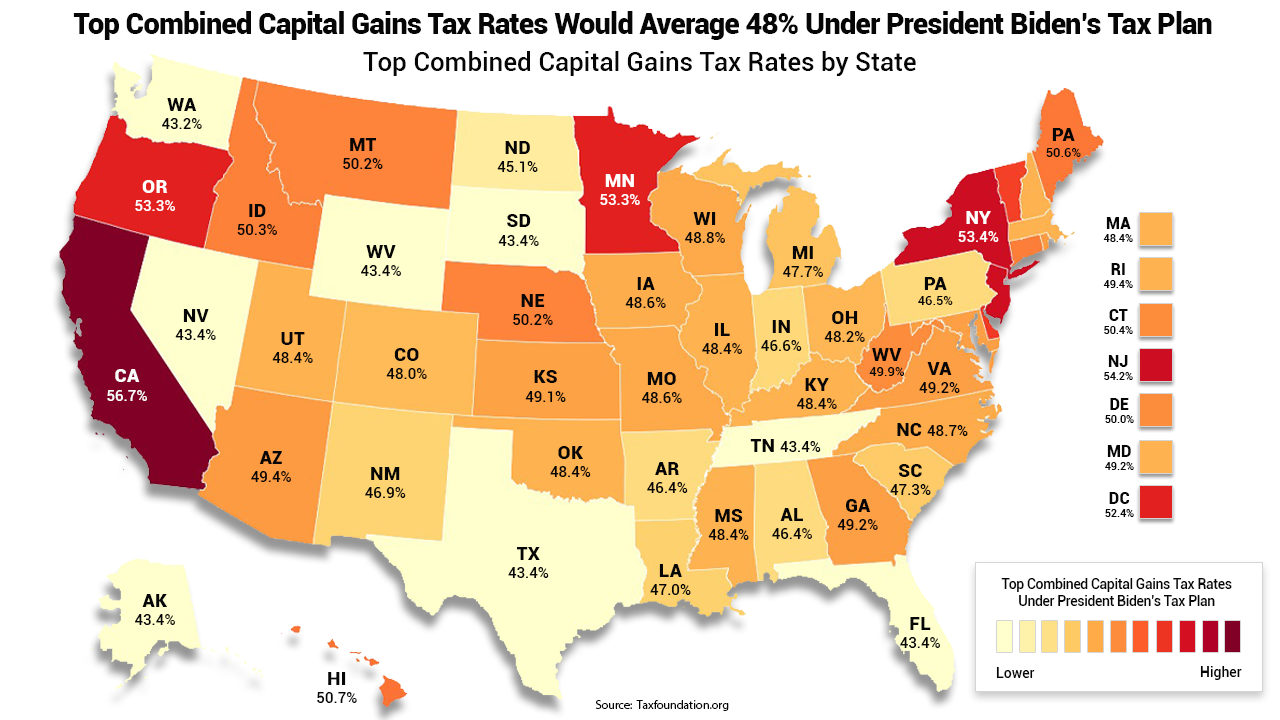

The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent Surtax on capital gains and the marginal effect of Pease Limitations which increases the tax rate by 118 percent.

. Married filing joint 200000. Deduction of 50 of capital gains or up to 1000 whichever is greater. The Hawaii capital gains tax on real estate is 725.

In cases where you paid all of your GE TA and capital gains taxes owed to Hawaii and the income tax owned to Hawaii on computed capital gains are less than the amount withheld you can file for a refund of the HARPTA withholding. State Tax Preferences for Capital Gains. Uppermost capital gains tax rates by state 2015 State State uppermost rate Combined uppermost rate Hawaii.

Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or head of household. Kind of property and description Example. Hawaiis tax system ranks 41st overall on our.

Income tax rate schedules vary from 14 to 825 based on taxable income and filing status. Long-term gains are those realized in more than one year. Hawaii Capital Gains Tax.

Short-term capital gains are taxed at the full income tax rates listed above. Head of household 150000 are not allowed the. 52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property.

Form N-15 for the year is available then the owner should file the appropriate tax return instead of. 100 shares of Z Co b. You will pay either 0 15 or 20 in tax on long-term capital gains which are gains that are realized from the sale of investment you held for at least one year.

Hawaii has a graduated individual income tax with rates ranging from 140 percent to 1100 percent. Taxpayers with federal adjusted gross income over certain thresholds single 100000. Itemized deductions generally follow federal law.

Hawaiis maximum marginal income tax rate is the 1st highest in the United States ranking directly below Hawaiis. States That Dont Tax Capital Gains. A Washington capital gains tax credit for the amount of any legally imposed income or excise tax paid by the individual to another taxing jurisdiction on capital gains derived from capital assets within the other taxing jurisdiction to.

Hawaiis capital gains tax rate is 725. If the collected amount is too large how do you obtain a refund. That applies to both long- and short-term capital gains.

Capital Gains Tax in Hawaii. You do this by filing a non resident Hawaii Income Tax form known as Form N15. For complete notes and annotations please see the source below.

2016REV 2016 To be filed with Form N-35 Name Federal Employer ID. Only 75 of capital gains are taxed. In Hawaii the taxes you pay on long-term capital gains will depend on your taxable income and filing status.

STATE OF HAWAIIDEPARTMENT OF TAXATION SCHEDULE D FORM N-35 Capital Gains and Losses and Built-in Gains. If the appropriate Hawaii income tax return ex. A business and occupation BO tax credit for BO taxes due on the same sale or exchange which is subject to the Washington capital gains tax.

But this might require some waiting. Capital gains are taxed at 72 lower than rate for ordinary income of up to 11. Short-term gains are taxed as ordinary income based on your personal income tax bracket.

After federal capital gains taxes are reported through IRS Form 1040 state taxes may also be applicable. The current top capital gains tax rate is 725 which critics point out is a lower tax rate than many Hawaii residents pay on their wages and salaries. Gain is determined largely by appreciation how much more valuable a property is when sold compared to the price paid when it was purchased.

Under current law a 44 tax. General coverage of federal laws that are relevant to Hawaii income tax or Hawaii estate tax. The bill would increase the tax on capital gains to 11 from 725 and increase the corporate income tax rate to 96.

What is the actual Hawaii capital gains tax. Includes short and long-term Federal and State Capital Gains Tax Rates for 2021 or 2022. Only 50 of capital gains are taxed.

Hawaii has a 400 percent state sales tax rate a 050 percent max local sales tax rate and an average combined state and local sales tax rate of 444 percent. Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds. If the 725 of sales price withholding is too large the owner files a Hawaii form N-288C after closing.

Capital gains are currently taxed at a rate of 725 Inheritance and Estate Tax and Inheritance and Estate Tax Exemption Generally only estates worth more than 5490000 must file an estate tax. In Hawaii long-term capital gains are taxed at a maximum rate of 725 while short-term capital gains are taxed at the full income tax rates listed above. PART I Short-Term Capital Gains and Losses Assets Held One Year or Less a.

Like the Federal Income Tax Hawaiis income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. Tax Foundation The High Burden of State and Federal Capital Gains Tax Rates accessed October 26 2017. Based on filing status and taxable income long-term capital gains for tax year 2022 will be taxed at 0 15 and 20.

Long term capital gains are taxed at a maximum of 725. Hawaii taxes gain realized on the sale of real estate at 725.

What Is Capital Gains Tax And When Are You Exempt Thestreet

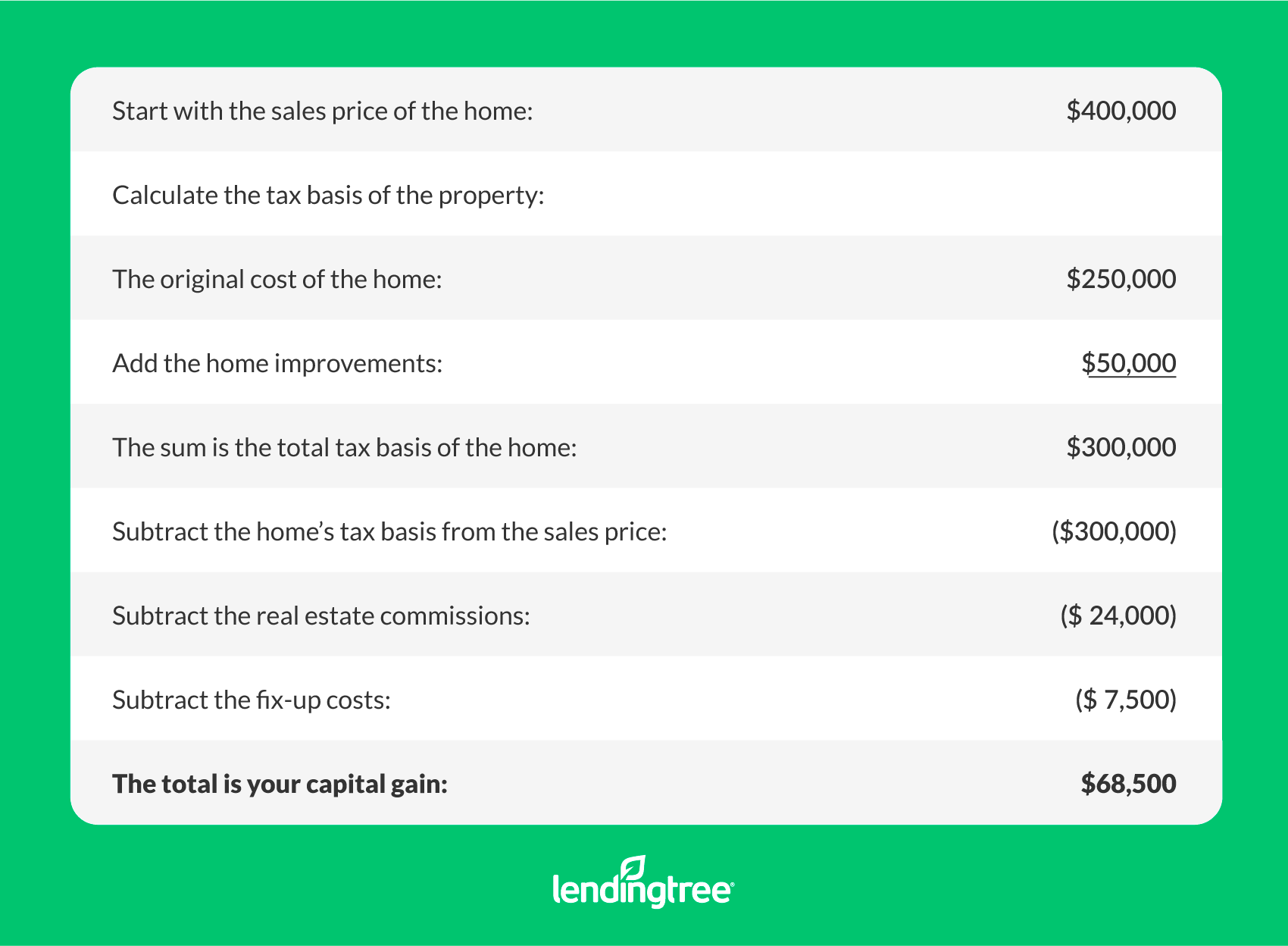

How To Calculate Capital Gains Tax H R Block

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition

Capital Gains Tax On A Home Sale Lendingtree

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

What Are Capital Gains Tax On Home Sale In Dallas

Capital Gains Tax Calculator 2022 Casaplorer

Mapped Biden S Capital Gain Tax Increase Proposal By State

Capital Gains Tax When Selling A Home In Massachusetts Pavel Buys Houses

The Preferential Tax Treatment Of Capital Gains Income Should Be Curbed Not Substantially Expanded Itep

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

The Tax Impact Of The Long Term Capital Gains Bump Zone

Long Term Capital Gains Tax What It Is How To Calculate Seeking Alpha

2022 Capital Gains Tax Rates By State Smartasset

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition

How High Are Capital Gains Taxes In Your State Tax Foundation

Biden S Proposed Capital Gains Tax Hike Might Hit Wealthy Americans With 57 Rate Study Shows Fox Business

Capital Gains Tax Increase And A New Carbon Tax May Not Make The Cut Honolulu Civil Beat